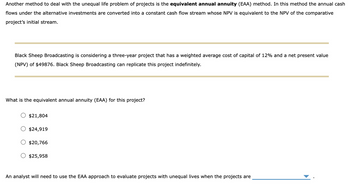

Equivalent Annual annuity (EAA) is a powerful financial metric used to match funding projects with different lifespans. It offers a standardized method to consider the profitability of tasks by converting their money flows into an equivalent annual stream. EAA is particularly helpful when evaluating initiatives that have various durations, making it an essential software for decision-makers in capital budgeting. While the EAA approach is a great tool for evaluating projects with regular and predictable cash flows, it’s essential to acknowledge its limitations. By conducting a complete comparative analysis, businesses can make more knowledgeable funding choices and mitigate potential monetary risks. When faced with the limitations of the EAA strategy, it turns into imperative to discover different analysis methods to make knowledgeable funding choices.

This method helps to overcome biases which will come up from focusing solely on complete money flows or time horizons. Ultimately, the EAA facilitates informed decision-making by considering the current value of cash flows and the time worth of cash. From a person’s perspective, the EAA approach supplies equivalent annual annuity eaa a transparent and concise approach to evaluate investment options. It takes into account both the timing and magnitude of cash flows, allowing individuals to evaluate the true value of various investment opportunities. This approach is especially useful when evaluating initiatives with different time horizons or money flow patterns.

Instance Of The Equal Annual Annuity Formulation

Comparing these figures, we are ready to see that Choice B presents the very best equivalent annual cost, making it the most enticing funding option. From a financial perspective, it helps us assess the profitability and viability of funding options. From a managerial perspective, it aids in decision-making by considering the long-term implications of different selections. The EAA methodology makes it simpler to match projects with completely different durations by changing them into an annualized metric. This simplification is helpful for decision-makers who may in any other case struggle with comparing tasks of varying lengths and money flows.

The Significance Of Analyzing Cash Flows

Another means to consider EAA is that it measures the financial efficiency of each project (i.e., the typical annual cash move that the business will see). Annuities are financial products that provide a gradual stream of revenue over a specified period of time, typically in retirement. They are designed to offer a reliable source of income, making certain that people have a consistent money move to satisfy their financial wants. Annuities could be a essential component of retirement planning, offering stability and security in an uncertain monetary panorama. It Is necessary to note that the EAA provides a standardized measure for evaluating projects, nevertheless it shouldn’t be the solely real think about decision-making. Different factors similar to risk, strategic alignment, and qualitative considerations must also be taken into consideration.

Let’s examine the EAA method with NPV, one of the most extensively used analysis strategies. NPV considers the time value of cash, permitting for a extra accurate evaluation of a project’s profitability. By discounting future money flows to their current worth, NPV supplies a clearer picture of the project’s internet contribution to the firm’s value.

Exploring Different Life Spans In Capital Budgeting

Considering project lifespans, money circulate consistency, risk, and other choice standards are important for making knowledgeable funding decisions. The EAA approach serves as a helpful tool in evaluating cash flows, however it ought to be complemented with a holistic assessment of all related elements to ensure one of the best determination is made. It permits for a comprehensive understanding of economic health, viability of investments, liquidity, solvency, and comparability of financing choices. The Equivalent Annual Annuity (EAA) strategy additional enhances the evaluation by providing a standardized metric for evaluating initiatives. By leveraging cash circulate evaluation and the EAA approach, people and organizations can make knowledgeable choices that align with their financial goals and maximize their potential for achievement. Understanding money flows in financial evaluation is essential for businesses, buyers, and analysts alike.

The annuity issue represents the current value of an annuity of $1 acquired annually over the project’s life span. By evaluating the EAA values of various initiatives, you’ll be able to determine essentially the most financially enticing choice. Remember, the Equivalent Annual Annuity methodology offers a complete framework for comparing capital budgeting projects with completely different life spans. By understanding this methodology and applying it diligently, businesses can make knowledgeable selections and allocate their sources effectively. Beginning with the fundamentals, Equal Annual Annuity (EAA) is a monetary metric used to compare the financial value of money flows that happen at completely different deadlines. This comparability significantly finds its footing when we analyze funding tasks which harbor distinct lifespans or profiles of cash receipts.

By considering the preliminary funding, maintenance prices, and potential power financial savings, traders can make informed selections concerning the adoption of renewable energy solutions. While the EAA calculation supplies useful insights into funding choices, it is essential to consider its limitations. The accuracy of the calculation depends on the accuracy of the discount price and the projected money flows. Additionally, the EAA calculation assumes that the investor will reinvest the annual funds at the similar discount fee, which may not all the time be feasible. By considering the time worth of cash, people can determine the true price of borrowing, evaluate https://www.personal-accounting.org/ the profitability of funding opportunities, and make more accurate financial projections. Decoding the EAA results requires a comprehensive evaluation that goes past comparing numerical values.

- It Is essential to note that the EAA provides a standardized measure for comparing tasks, however it should not be the solely real factor in decision-making.

- By changing the money flows into an annual payment, the EAA approach helps in figuring out the most economically beneficial possibility.

- In abstract, Equivalent Annual Annuity (EAA) simplifies project comparisons by converting NPVs into annual equal cash flows.

- When it comes to creating investment choices, understanding the idea of equivalent annual annuity (EAA) evaluation can be extremely beneficial.

- The versatility of EAA extends to varied monetary eventualities, particularly in retirement planning.

- These are probably the most accessed Finance calculators on iCalculator™ over the previous 24 hours.

The equal annual annuity method is considered one of two strategies used in capital budgeting to compare mutually unique projects with unequal lives. The EAA strategy calculates the constant annual cash circulate generated by a project over its lifespan if it was an annuity. When used to compare projects with unequal lives, an investor should choose the one with the upper EAA. The EAA approach additionally permits people to compare investments with different time horizons. For instance, if you are considering two projects with different lifespans, the EAA may help you determine which choice provides a higher annual return.

The formulation for NPV accounts for future values with adverse cash flows representing costs and constructive money flows representing returns. By demonstrating numerous examples, users be taught to effectively calculate NPV in different situations, making certain a comprehensive understanding of this monetary idea. Additionally, advanced VBA scripts can provide further assist by offering enter prompts and steering during calculations, enhancing the consumer expertise. Overall, mastering NPV in Excel facilitates knowledgeable funding choices by evaluating the current value of anticipated future returns. The equal annual annuity (EAA) approach is considered one of two strategies used in capital budgeting to match mutually unique initiatives with unequal lives.

In essence, EAA standardizes these money flows into an equivalent stream of steady, annual payments. The Equivalent Annual Annuity (EAA) strategy or equal annual money move method is a capital budgeting approach. The benefit of the Equivalent Annual Annuity approach however, is that it is easier than the least common multiple of lives methodology. Monetary analysts and managers use EAA in capital budgeting decisions to select initiatives that align with the company’s strategic goals. The method helps in prioritizing investments based on their equivalent annual returns, thereby optimizing resource allocation.

Leave a Reply